Unraveling Wells Fargo Wire Transfers

Ever found yourself needing to move a hefty sum of money quickly and securely? Maybe you're buying a house, investing in a business venture, or sending funds internationally. In the world of financial transactions, wire transfers reign supreme for these kinds of situations. And if you're a Wells Fargo customer, understanding how to navigate their specific wire transfer process is essential. This guide dives deep into the world of Wells Fargo wire transfers, offering a comprehensive exploration of everything you need to know.

Imagine money as water flowing through a vast network of pipes. A wire transfer is like opening a valve and directing a concentrated stream of that water directly to its intended destination. It's a rapid, electronic method of transferring funds between banks, often across different countries. Wells Fargo, being a major financial institution, provides this service to its customers, allowing them to send and receive money efficiently.

So, what exactly are Wells Fargo wire transfer instructions? They are essentially the set of specific details required to initiate and complete a wire transfer through Wells Fargo. These instructions act as the roadmap for your money, ensuring it reaches the right account safely and securely. Think of them as the precise coordinates needed to pinpoint the destination on a financial map.

Wire transfers have a rich history, evolving from their telegraph-based origins in the 19th century to the sophisticated electronic systems we use today. The core principle remains the same: rapid, direct transfer of funds. Wells Fargo, with its long-standing presence in the financial landscape, has played a significant role in shaping and offering this service. The importance of accurate wire transfer instructions cannot be overstated. Incorrect information can lead to delays, returned funds, or even the loss of money.

One of the main issues surrounding wire transfers, regardless of the bank, is the potential for fraud. Scammers often try to trick individuals into sending money through wire transfers, as they are difficult to reverse. Understanding the process and following security best practices is crucial to mitigating this risk when using Wells Fargo's wire transfer services.

Wells Fargo wire transfers offer several benefits. They are generally faster than other forms of payment, especially for large sums. They provide a high level of security with proper precautions and offer a reliable way to send and receive money internationally. For example, if you need to quickly pay a deposit on a property overseas, a wire transfer through Wells Fargo can ensure the funds arrive promptly and securely.

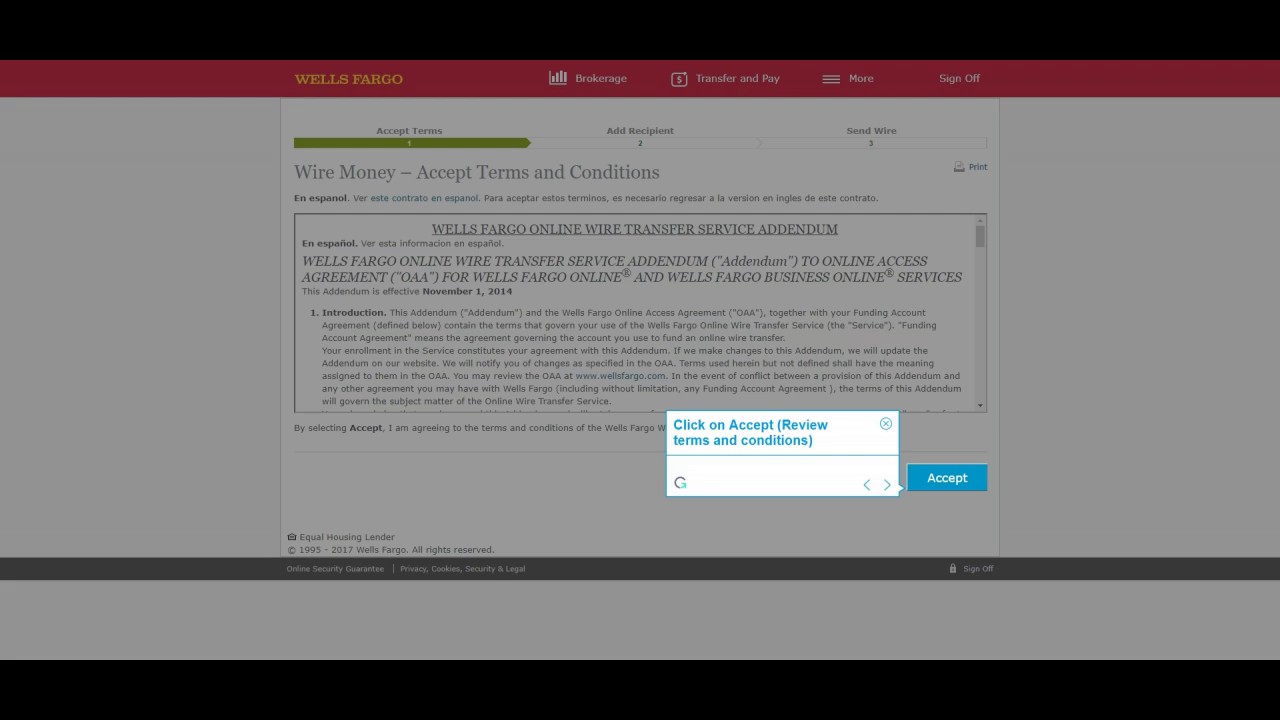

To initiate a Wells Fargo wire transfer, you'll need specific information, including the recipient's bank name and address, their account number, the SWIFT code for international transfers, and the amount being sent. You can typically initiate a wire transfer online, in person at a branch, or by phone. Wells Fargo provides detailed instructions on their website and through customer service.

Advantages and Disadvantages of Wells Fargo Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversibility |

| International Capabilities | Potential for Fraud |

Best practices include verifying all recipient details, using strong passwords for online banking, and being cautious of any suspicious requests for wire transfers. Double-checking every piece of information is paramount to a successful transaction.

Frequently Asked Questions about Wells Fargo Wire Transfers often include inquiries about fees, processing times, international transfer limits, and how to track a transfer. Wells Fargo's website provides comprehensive answers to these and other common questions.

In conclusion, navigating the intricacies of Wells Fargo wire transfer instructions may seem daunting at first, but with a clear understanding of the process and adherence to best practices, it can be a smooth and efficient way to manage your finances. From understanding the historical context to grasping the modern implications, knowing how to effectively use wire transfers empowers you to move your money where it needs to go securely and quickly. Take the time to familiarize yourself with Wells Fargo's specific guidelines and utilize the resources available to ensure your wire transfers are handled safely and successfully. By being informed and proactive, you can harness the power of this essential financial tool.

Decoding the nc float switch symbol your guide to liquid level control

Effortless pool cleaning with the dolphin e20

Unlocking fifa 19s defensive powerhouse left backs