Unlocking Your Business Success: The Power of Company Accounting Sheets

Imagine your business as a vast, intricate machine with countless moving parts. How do you keep track of all those intricate processes, the inflows and outflows, the financial heartbeat that keeps it all running? The answer, surprisingly, lies within a seemingly simple document: the company accounting sheet, or in Spanish, the hoja de contabilidad empresa. This unassuming record is more than just a collection of numbers; it's a powerful tool that can unlock crucial insights into your business's health and pave the way for future success.

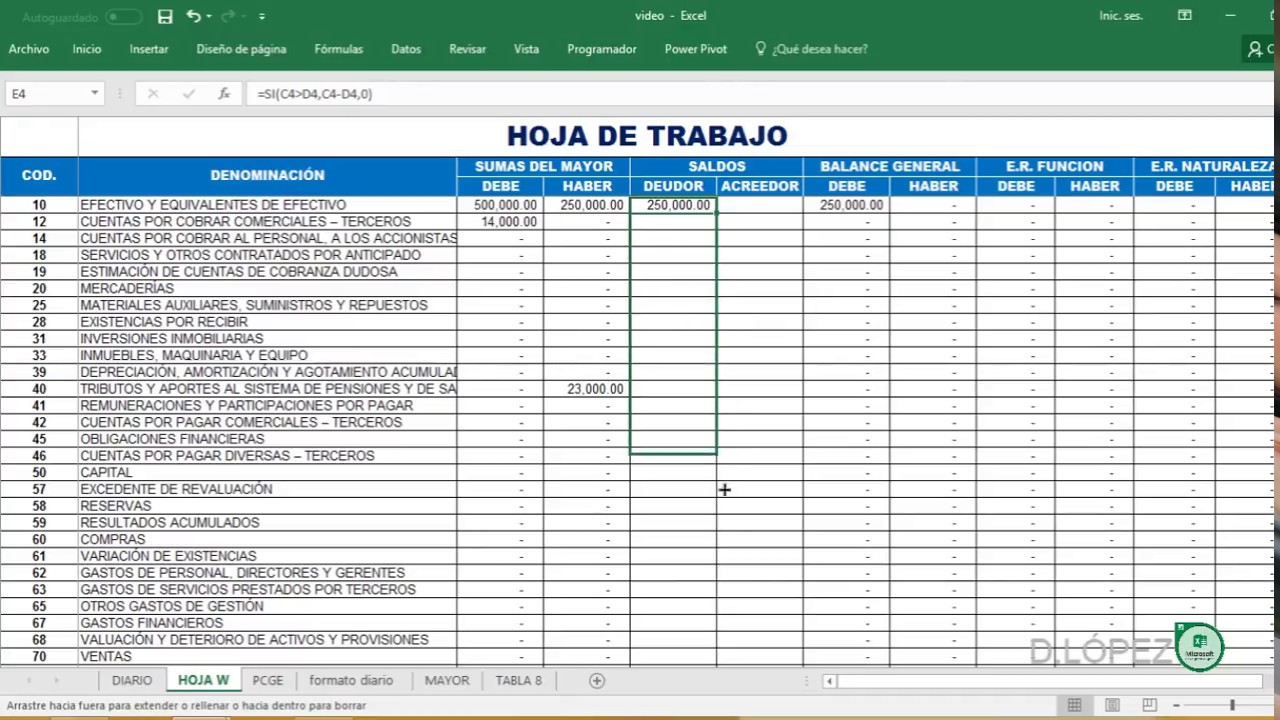

So, what exactly is a company accounting sheet? Think of it as a financial snapshot, a detailed record of a company's assets, liabilities, and equity at a specific point in time. This "balance sheet," as it's often called, provides a clear picture of what a company owns, what it owes, and the value of the owner's investment. Whether you're a seasoned entrepreneur or just starting out, understanding the nuances of the hoja de contabilidad empresa is fundamental to effective financial management.

The history of accounting sheets stretches back centuries, evolving alongside the development of commerce itself. From simple clay tablets used by ancient Mesopotamians to the sophisticated digital spreadsheets we use today, the core principle remains the same: to provide a systematic record of financial transactions. This historical context underscores the enduring importance of the hoja de contabilidad empresa in the business world.

The importance of maintaining accurate and up-to-date company accounting records cannot be overstated. These records are essential for a variety of purposes, from securing loans and attracting investors to making informed business decisions and complying with tax regulations. A well-maintained hoja de contabilidad empresa offers a transparent view of a company's financial position, enabling stakeholders to assess its stability and potential for growth.

One of the main issues surrounding company accounting sheets is the potential for errors and inconsistencies. Inaccurate data can lead to misinformed decisions, missed opportunities, and even legal repercussions. Therefore, it's crucial to implement robust accounting practices and utilize reliable accounting software to ensure the accuracy and integrity of your hoja de contabilidad empresa.

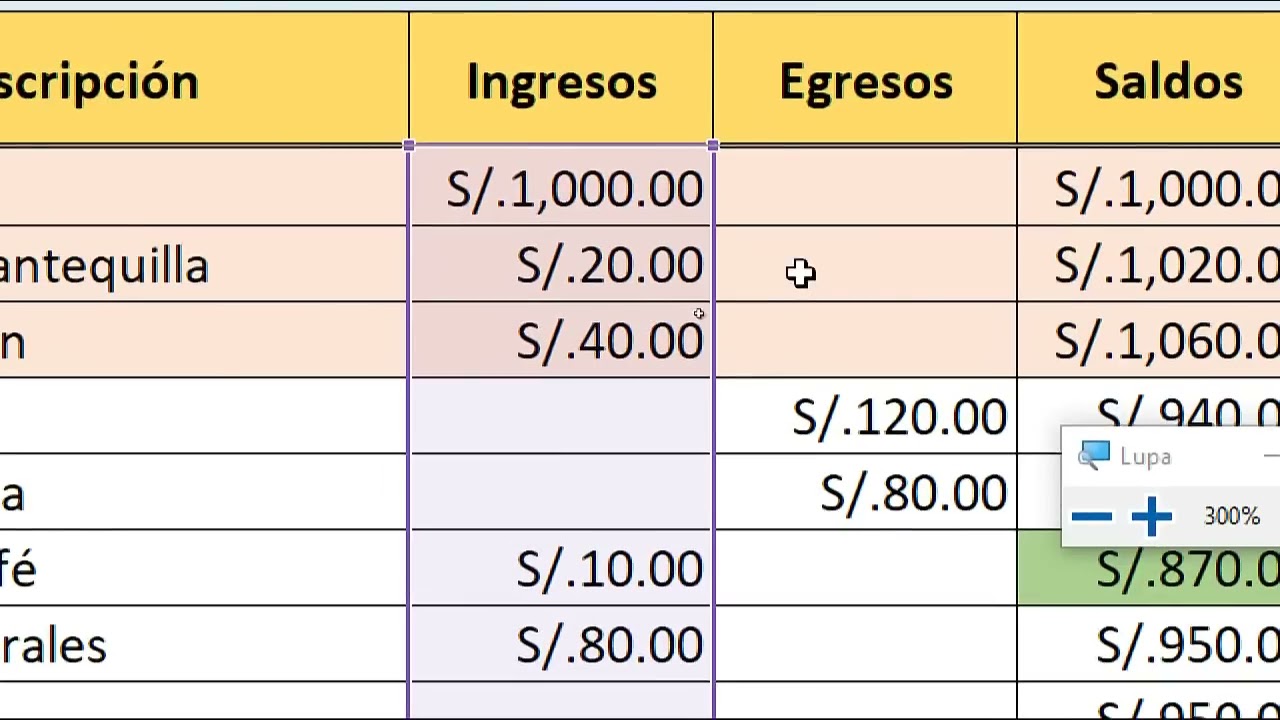

A simple example of a company accounting sheet would include entries for assets such as cash, accounts receivable, and inventory, balanced against liabilities like accounts payable and loans, with the difference representing the owner's equity.

Benefits of using a hoja de contabilidad empresa include: 1) Informed decision-making based on accurate financial data. 2) Improved financial management through tracking income, expenses, and assets. 3) Enhanced credibility with lenders and investors.

An action plan for implementing a robust accounting system involves: 1) Choosing suitable accounting software. 2) Establishing a consistent recording process. 3) Regularly reviewing and reconciling accounts.

Advantages and Disadvantages of Maintaining a Detailed Hoja de Contabilidad Empresa

| Advantages | Disadvantages |

|---|---|

| Provides a clear overview of financial health | Can be time-consuming to maintain |

| Helps in informed decision making | Requires expertise for complex transactions |

| Essential for securing loans and attracting investors | Prone to errors if not managed carefully |

Best Practices: 1) Use accounting software. 2) Reconcile bank statements. 3) Track all transactions. 4) Back up data regularly. 5) Consult with an accountant.

FAQ: 1) What is a balance sheet? 2) What are assets and liabilities? 3) How do I create a balance sheet? 4) What is the accounting equation? 5) What is owner's equity? 6) Why is accounting important? 7) How often should I update my balance sheet? 8) Where can I find more resources on accounting?

In conclusion, the hoja de contabilidad empresa, or company accounting sheet, is a vital tool for any business, regardless of size or industry. From tracking financial performance to informing strategic decisions, its impact on a company's success is undeniable. By understanding its importance, implementing best practices, and seeking professional guidance when needed, you can harness the power of the company accounting sheet to drive growth, enhance profitability, and secure a brighter financial future for your business. Don't underestimate the power of this seemingly simple document; it can be the key to unlocking your business's full potential. Take the time to learn, to implement, and to watch your business flourish. Your future self will thank you.

Unveiling the magic of benjamin moore hidden sapphire

Sherwin williams white beige the ultimate guide to warm neutrals

Houston super bowl countdown when will the big game return