Unlocking Financial Clarity: Mastering Excel Accounting Spreadsheets

Imagine having a clear, concise, and instantly accessible overview of your financial health. This is the power that an Excel accounting spreadsheet, or "hoja de trabajo contabilidad excel" in Spanish, can provide. Whether you're a small business owner, a freelancer, or managing personal finances, understanding the nuances of these digital ledgers can transform your financial management.

Excel, a ubiquitous software found on almost every computer, offers more than just basic calculations. Its versatility allows for the creation of powerful accounting spreadsheets tailored to specific needs. From tracking daily transactions to generating complex financial reports, a well-structured Excel spreadsheet becomes an indispensable tool for financial control.

The concept of accounting worksheets predates digital technology. Historically, accountants meticulously recorded transactions on paper ledgers, a painstakingly manual process. The arrival of spreadsheet software revolutionized accounting, offering automation, accuracy, and the ability to quickly manipulate and analyze data. This transition to digital greatly impacted the profession, speeding up processes and reducing human error.

Today, Excel's ability to create accounting worksheets (hoja de trabajo contabilidad excel) has become a core skill in business. These digital tools allow for real-time tracking of income, expenses, assets, and liabilities. The insights derived from these sheets inform critical business decisions, from budgeting and forecasting to investment strategies and tax planning.

However, while Excel offers immense power, it's crucial to use it correctly. Incorrect formulas, inconsistent data entry, and a lack of proper structure can lead to inaccuracies and flawed financial reporting. This emphasizes the importance of understanding best practices and utilizing available resources to create effective accounting spreadsheets.

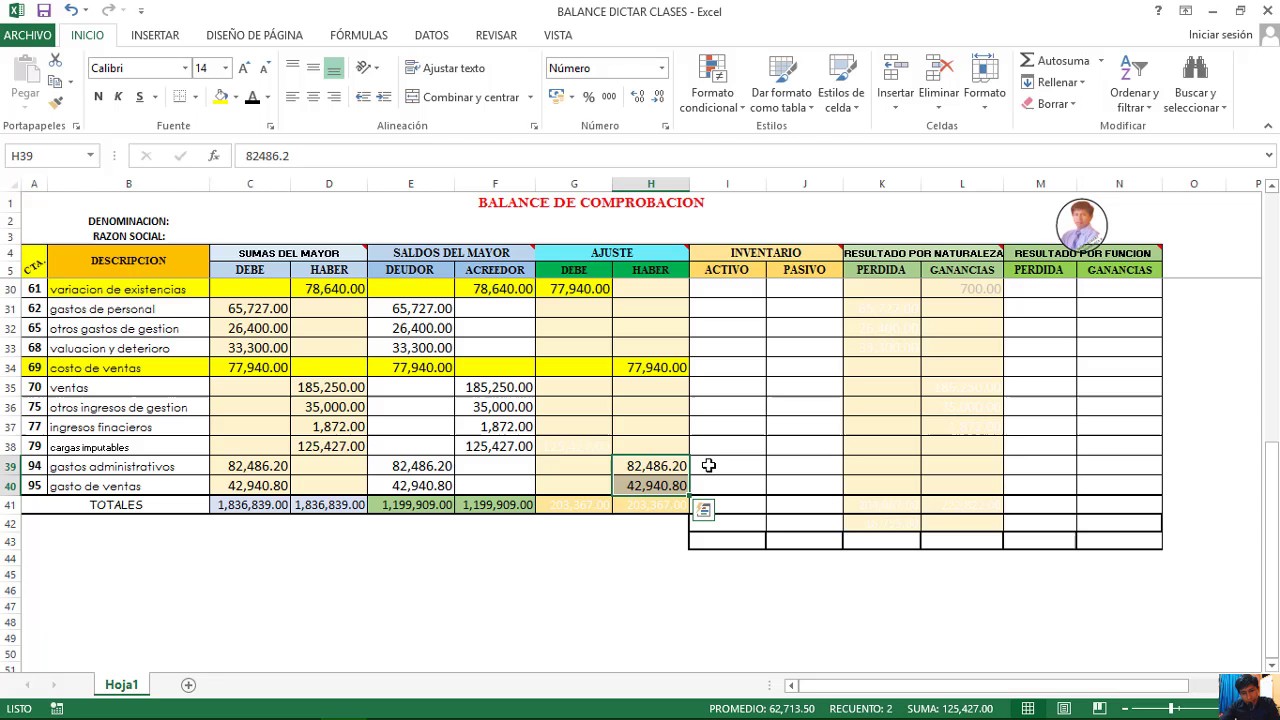

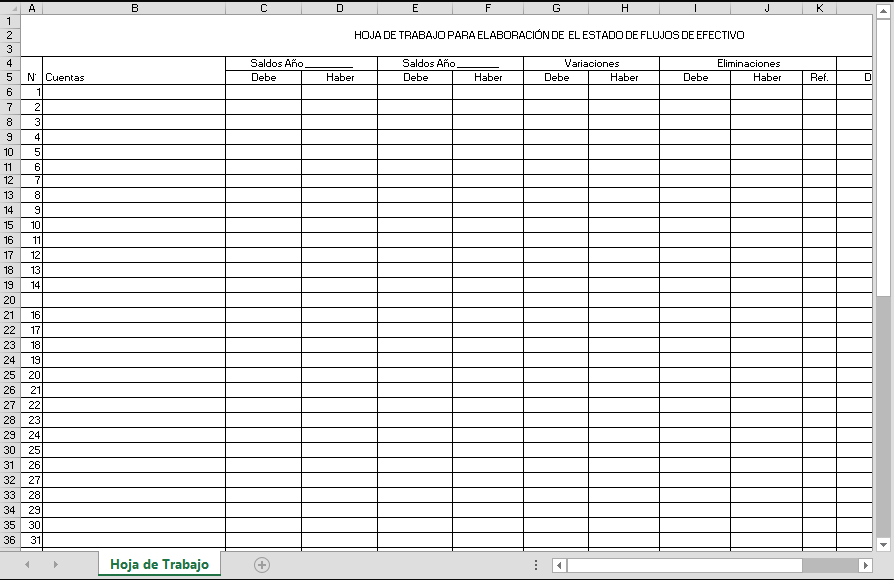

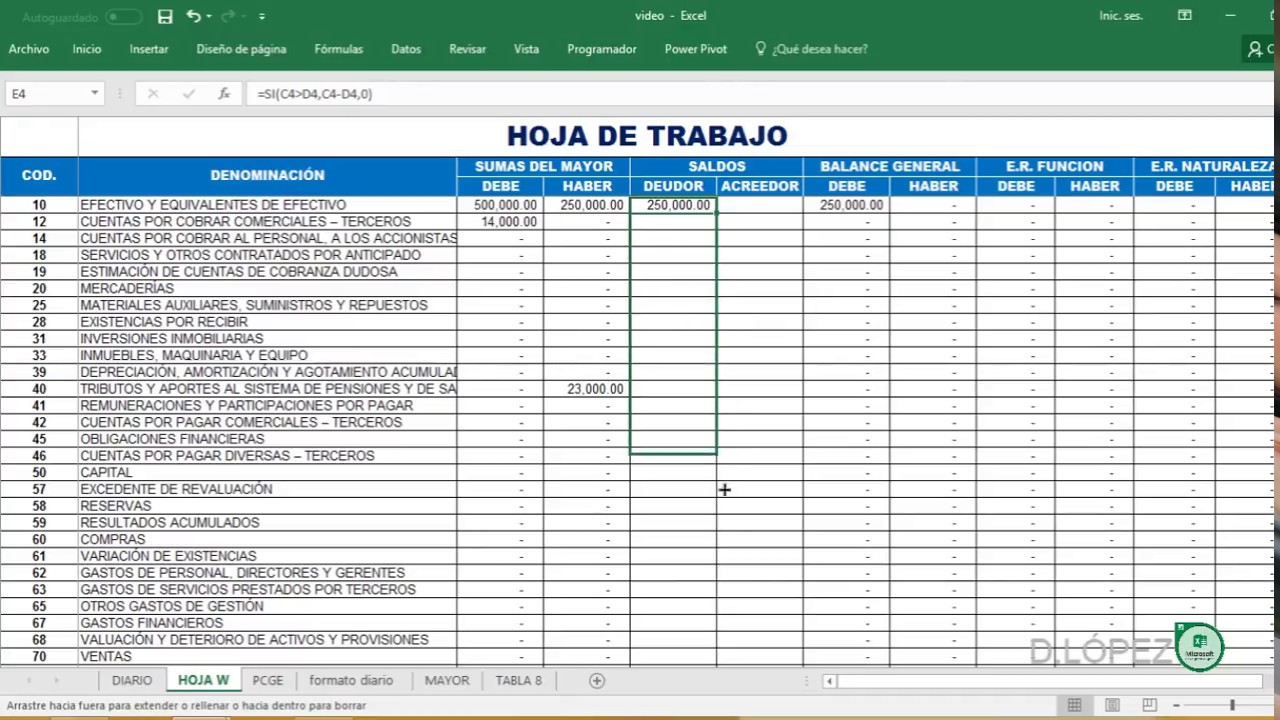

An Excel accounting worksheet (hoja de trabajo contabilidad excel) is essentially a structured digital document designed for recording and analyzing financial transactions. It utilizes formulas and functions to automatically calculate key financial metrics, freeing up the user to focus on interpretation and analysis. A simple example would be a sheet tracking monthly sales, with separate columns for date, product sold, quantity, price per unit, and total sales. A formula would automatically calculate the total sales for each entry and the overall monthly sales.

Benefits of utilizing Excel for accounting worksheets include its accessibility, affordability, and customizability. Its widespread availability removes the need for specialized software. The relatively low cost of Excel, especially compared to dedicated accounting software, makes it an attractive option for individuals and small businesses. The customizable nature of Excel allows users to tailor their worksheets to match their specific needs and preferences.

To create an effective accounting worksheet, start by clearly defining your objectives. What information do you need to track? What reports do you want to generate? Next, design the structure of your worksheet, including columns for relevant data points. Implement formulas for automatic calculations and ensure consistent data entry. Regularly review and update your worksheet to maintain accuracy.

Advantages and Disadvantages of Excel for Accounting

| Advantages | Disadvantages |

|---|---|

| Accessibility | Limited Collaboration Features |

| Affordability | Potential for Errors |

| Customizability | Data Security Risks |

Best practices include using clear and consistent labeling, implementing data validation to prevent errors, regularly backing up your files, utilizing built-in functions for calculations, and protecting sensitive data with passwords.

Examples of Excel accounting worksheets include basic income statements, balance sheets, cash flow statements, inventory tracking sheets, and expense reports. Each sheet serves a different purpose, providing insights into specific aspects of financial performance.

Challenges in using Excel for accounting might include the lack of built-in audit trails, limited collaboration features, and potential for data corruption. Solutions include implementing version control, using cloud-based storage for collaboration, and regularly backing up data.

Frequently asked questions often revolve around creating formulas, formatting cells, importing and exporting data, protecting worksheets, and using specific functions. Resources like online tutorials, help forums, and Excel documentation can provide answers to these queries.

Tips for maximizing your use of Excel include mastering keyboard shortcuts, utilizing templates, learning advanced functions, and exploring add-ins for specialized tasks.

In conclusion, Excel accounting spreadsheets (hoja de trabajo contabilidad excel) offer a powerful and accessible way to manage finances. By understanding best practices, utilizing available resources, and continuously refining your skills, you can unlock the full potential of Excel to gain clarity, control, and confidence in your financial management. From tracking daily transactions to generating comprehensive reports, a well-structured Excel spreadsheet becomes a vital tool for informed decision-making and financial success. Take the time to invest in learning and mastering Excel for accounting – it’s a skill that will pay dividends in the long run, contributing to your overall financial well-being and empowering you to make strategic financial choices.

Lucrative trade careers in your area

The art of joining fly line and leader

Dive into the world of do it with me manhwa