Understanding North Carolina State Employee Pay

Navigating the financial landscape as a North Carolina state employee starts with understanding your pay schedule. This recurring cycle influences budgeting, planning, and overall financial well-being. It's a fundamental aspect of employment, impacting how you manage your income and expenses.

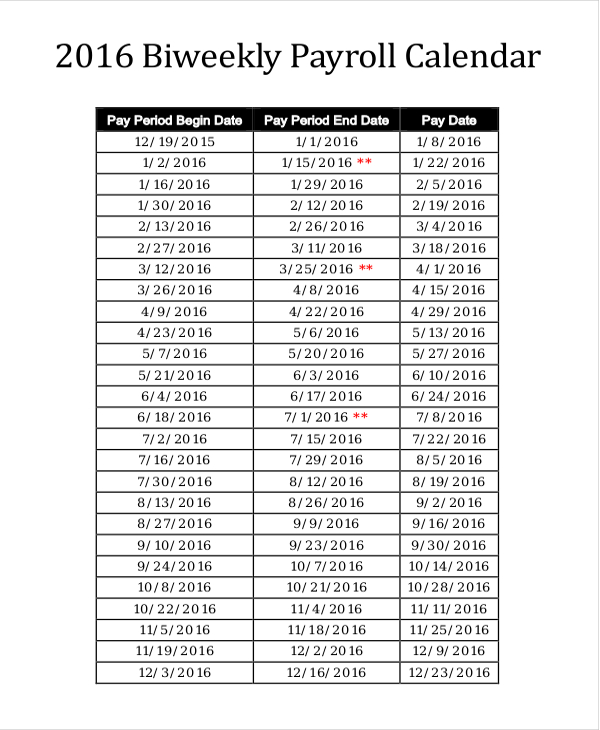

The North Carolina state government operates on a bi-weekly payroll system. This means employees receive their paychecks every two weeks, typically on a designated day of the week. This regular payment cycle provides a predictable rhythm for managing personal finances. Understanding this schedule is key to effective budgeting and financial stability.

While a consistent paycheck offers stability, grasping the nuances of the bi-weekly pay schedule goes beyond simply knowing when to expect funds. It involves understanding how deductions for taxes, health insurance, and retirement contributions affect your net pay. This knowledge empowers employees to make informed financial decisions.

The origin of the bi-weekly pay schedule for state employees stems from a balance between administrative efficiency and employee needs. Processing payroll every two weeks allows for a manageable workload for the state's payroll system while providing employees with relatively frequent income. This frequency can be especially helpful for managing regular expenses and building a stable financial foundation.

However, the bi-weekly system can present unique challenges. With 26 paychecks in a year instead of 12 (like monthly pay), budgeting can sometimes feel more complex. There are two months each year where employees receive three paychecks. Planning ahead for these "extra" paychecks can be a beneficial strategy for savings or debt reduction.

One benefit of the NC state bi-weekly pay schedule is the more frequent influx of cash. Compared to a monthly pay schedule, receiving a paycheck every two weeks can simplify budgeting, particularly for covering recurring bills. For example, if your rent is due mid-month, a bi-weekly paycheck ensures you have the funds readily available.

Another advantage is the potential to accelerate debt repayment. By allocating a portion of each bi-weekly paycheck towards debt, you can make more frequent payments, potentially reducing the total interest paid over time. For example, making bi-weekly payments on a student loan can significantly shorten the repayment period.

A third benefit lies in the psychological advantage of frequent positive reinforcement. Receiving a paycheck every two weeks can provide a sense of progress and motivation, particularly when working towards financial goals. This regular affirmation can encourage continued responsible financial behavior.

Effective budgeting is crucial for managing a bi-weekly income. Use a budgeting tool, spreadsheet, or app to track income and expenses. Allocate funds for essential expenses like housing, utilities, and food, while also setting aside savings for future goals.

One useful tip is to treat one of your two monthly paychecks as your "bill" paycheck and the other as your "savings and discretionary spending" paycheck. This can simplify the budgeting process and ensure consistent progress toward your financial goals.

Advantages and Disadvantages of a Bi-Weekly Pay Schedule

| Advantages | Disadvantages |

|---|---|

| More frequent paychecks | More complex budgeting due to 26 paychecks per year |

| Easier to manage regular expenses | Potential for increased payroll processing fees (less relevant for employees) |

| Faster debt repayment |

Frequently Asked Questions

Q: When are NC state employees paid? A: State employees are paid on a bi-weekly schedule, typically on a set day of the week. Specific dates can be found on the State of North Carolina's Office of State Human Resources website.

Q: How do I access my pay stub? A: Pay stubs are typically accessible online through the state's employee self-service portal.

Q: What deductions are taken from my paycheck? A: Common deductions include federal and state taxes, retirement contributions, and health insurance premiums.

Q: Who can I contact with questions about my pay? A: Contact your agency's human resources department for questions specific to your pay.

Q: How does direct deposit work? A: Direct deposit electronically transfers your pay directly into your designated bank account.

Q: What happens if a payday falls on a holiday? A: Paydays falling on a holiday are typically adjusted, with payment issued on the preceding business day.

Q: Can I change my tax withholding? A: Yes, you can adjust your tax withholding through the employee self-service portal or by completing the necessary forms.

Q: How are overtime hours calculated? A: Overtime calculations vary by job classification and are governed by state regulations.

In conclusion, the North Carolina state bi-weekly pay schedule provides a structured and predictable framework for managing finances. While it presents some budgeting complexities due to the 26 paychecks received annually, the benefits of more frequent income, facilitated debt repayment, and consistent positive reinforcement contribute to overall financial well-being. By understanding the nuances of the bi-weekly system, utilizing budgeting tools, and seeking information from available resources, North Carolina state employees can effectively navigate their finances and achieve their financial goals. Taking proactive steps to understand your pay schedule and implement sound financial practices is an investment in your future financial security. Explore the resources available through the Office of State Human Resources to gain a deeper understanding and take control of your financial journey.

Puppy hydration guide 3 month old pup water intake

Matching benjamin moore colors with sherwin williams

Navigating the subtleties of power dynamics and inner resilience