Ocean City NJ Property Tax Secrets Revealed

So, you're thinking about Ocean City, New Jersey. Sun, sand, surf... and property taxes. Let's face it, nobody *loves* paying taxes, but understanding the system can save you headaches (and maybe even some cash) down the line. Navigating Ocean City, NJ property tax records might seem like a daunting task, but we're here to break it down for you.

Whether you're a seasoned real estate investor, a curious resident, or just dreaming of owning a piece of that sweet Jersey Shore pie, knowing how to find and interpret Ocean City property tax data is essential. Think of it as your secret weapon in the world of Ocean City real estate.

From charming beachfront bungalows to sprawling Victorian mansions, Ocean City offers a diverse range of properties. But before you fall head over heels for that ocean view, you need to understand the financial implications. That's where Ocean City NJ property tax records come in.

These records are a treasure trove of information, providing insights into property values, assessment history, and tax rates. By accessing these records, you can gain a clearer picture of the true cost of ownership in Ocean City.

Now, let's get down to the nitty-gritty. How do you actually *find* these elusive Ocean City, NJ property tax records? The answer, my friend, lies in the digital age. Various online platforms and government websites offer access to this information, often with user-friendly search tools.

The history of property tax records in Ocean City, NJ is tied to the development of the city itself, reflecting its growth from a small resort town to a bustling summer destination. These records have always been important for municipal funding, ensuring the provision of essential services. However, access to these records wasn't always easy. Before the digital revolution, accessing Ocean City NJ property tax information meant a trip to the local tax assessor's office. Today, much of this information is available online, simplifying the process for everyone.

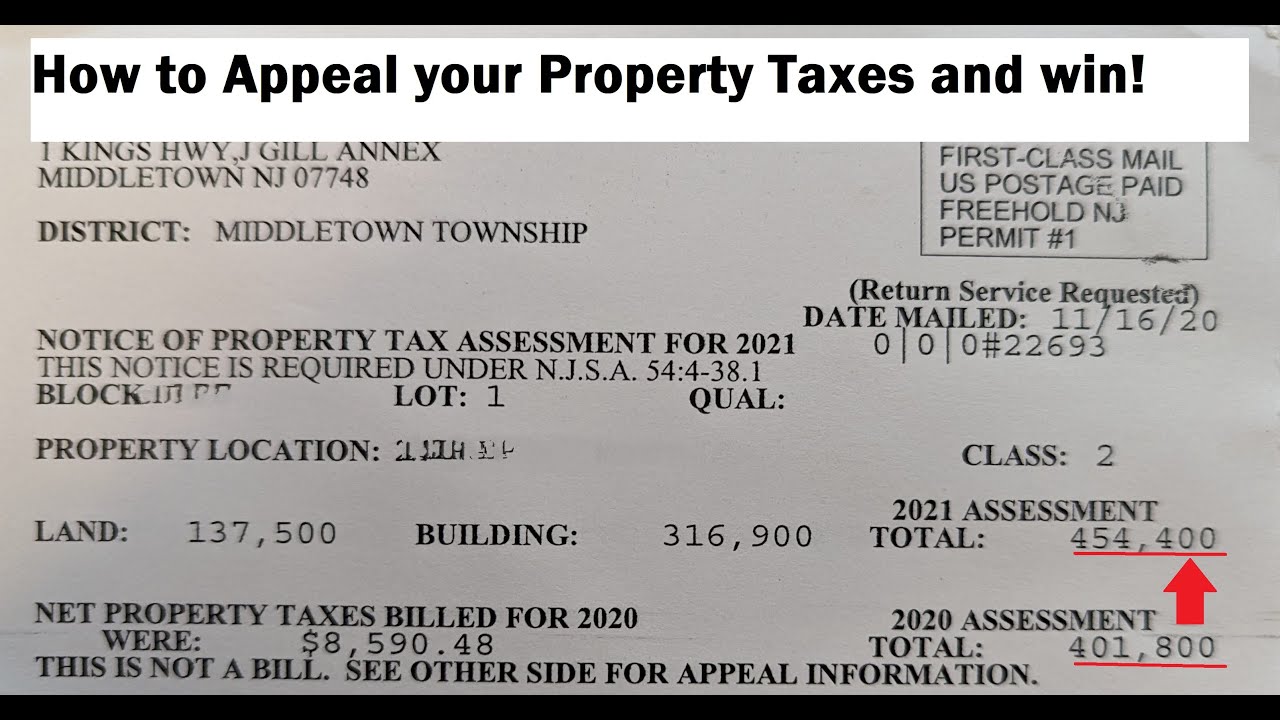

One of the main benefits of searching Ocean City, NJ property tax records is transparency. You can see how your property is assessed compared to your neighbors, ensuring a fair tax burden. For example, you can see if similar properties in your neighborhood are assessed at a lower value, which could be grounds for an appeal.

Another advantage is the ability to make informed investment decisions. By examining the property tax history of a potential investment property, you can assess the long-term financial implications and make a smarter purchase.

Finally, accessing Ocean City property tax data empowers residents to participate in local government and understand how their tax dollars are being used.

One simple way to search for Ocean City NJ property tax records is to visit the official website of the City of Ocean City. Typically, there's a dedicated section for tax information, allowing you to search by address, owner name, or block and lot number.

Advantages and Disadvantages of Ocean City NJ Property Tax Records Search

| Advantages | Disadvantages |

|---|---|

| Transparency in property assessments | Potential for data entry errors |

| Informed investment decisions | Information might not be completely up-to-date |

| Empowered civic engagement | Requires some technical skills to navigate online databases |

FAQ: What if I can't find my property online? Contact the Ocean City Tax Assessor's office directly. They can assist you with your search and provide the necessary information.

FAQ: How often are property taxes assessed in Ocean City? Typically, properties are assessed annually.

FAQ: Can I appeal my property tax assessment? Yes, there's a process for appealing your assessment if you believe it's inaccurate.

FAQ: Where can I find historical property tax data for Ocean City? Check the city archives or historical societies for older records.

FAQ: How are property tax rates determined in Ocean City? Tax rates are based on the municipal budget and the total assessed value of all properties in the city.

FAQ: What are property taxes used for in Ocean City? Property taxes fund essential services such as schools, public safety, and infrastructure.

FAQ: What is the difference between assessed value and market value? Assessed value is used to calculate property taxes, while market value reflects the price a property could sell for on the open market.

FAQ: How can I pay my Ocean City property taxes? You can usually pay online, by mail, or in person at the tax collector's office.

Understanding Ocean City, NJ property tax records is crucial for anyone interested in real estate in this vibrant coastal community. From making informed investment decisions to ensuring fair taxation, access to this information empowers residents and potential buyers alike. By utilizing the resources available online and offline, you can unlock the secrets of Ocean City property taxes and navigate the real estate market with confidence. Take the time to research, ask questions, and become an informed citizen. The knowledge you gain will be invaluable in your Ocean City journey.

Finding my aunt full episodes free a comprehensive guide

Chevy duramax 30l diesel is gms baby duramax worth it

Troy pound weight conversion explained