Navigating Wells Fargo International Wire Transfers

In today's interconnected world, moving money across borders is often a necessity. Whether it's for business transactions, supporting family abroad, or investing internationally, understanding the nuances of international wire transfers is crucial. This article aims to provide a comprehensive overview of navigating Wells Fargo's international wire transfer services, offering insights to help you manage your global finances effectively.

Sending or receiving money internationally can feel daunting, with various factors to consider, such as fees, exchange rates, and security. With Wells Fargo, one of the largest banks in the United States, understanding their specific procedures and requirements for international wire transfers is essential. This involves familiarizing yourself with their online platform, required documentation, and customer support resources.

The ability to transfer funds internationally is a cornerstone of modern banking. It facilitates global commerce, enables personal transactions across borders, and fosters financial connectivity. However, there's more to it than simply clicking a button. It's important to be aware of the regulations, security measures, and potential challenges associated with international wire transfers through Wells Fargo or any other financial institution.

This guide will delve into the specifics of Wells Fargo's international wire transfer service, exploring topics such as transfer limits, processing times, applicable fees, and necessary recipient information. We'll also examine the security protocols implemented by Wells Fargo to protect your funds and ensure the integrity of your transactions.

Navigating the intricacies of international finance requires careful planning and informed decision-making. This article serves as a valuable resource for anyone considering or currently using Wells Fargo for international wire transfers, equipping you with the knowledge to make informed choices and manage your global financial activities with confidence.

Historically, international money transfers were complex and time-consuming processes, often involving various intermediaries and significant delays. Today, advancements in technology and banking infrastructure have streamlined these procedures, making international transfers significantly faster and more accessible. Wells Fargo has adapted to these changes, offering a range of options for sending and receiving money globally.

One benefit of using Wells Fargo for international wire transfers is their extensive global network. This broad reach can simplify the transfer process, potentially reducing processing times and associated fees. Another advantage is their robust online platform, which provides a convenient way to initiate and track transfers. Finally, Wells Fargo offers customer support specifically for international transactions, providing assistance with inquiries and troubleshooting potential issues.

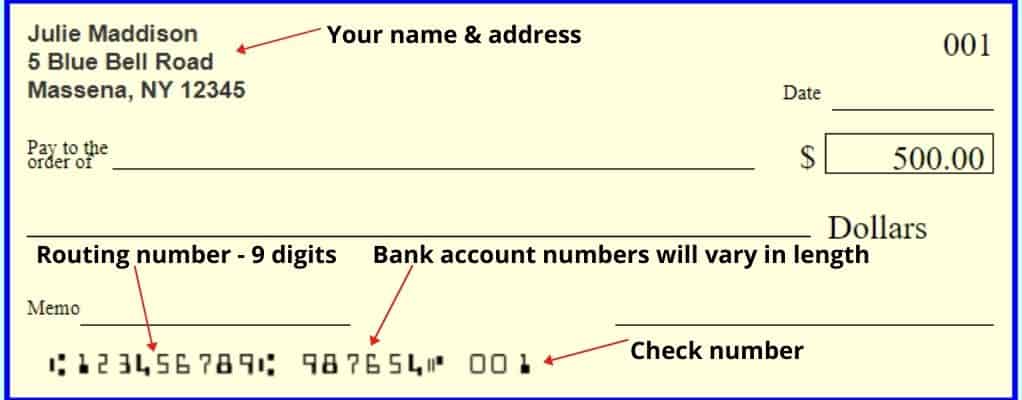

Before initiating an international wire transfer with Wells Fargo, gather all the necessary information, including the recipient's full name, address, bank details (SWIFT code, IBAN, etc.), and the amount to be sent. Ensure the accuracy of this information to avoid delays or complications.

Advantages and Disadvantages of Using Wells Fargo for International Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Extensive global network | Potential for higher fees compared to some other services |

| Robust online platform | Transfer limits may apply |

| Dedicated customer support for international transactions | Exchange rate fluctuations can impact the final amount received |

Best Practices:

1. Verify recipient details meticulously.

2. Understand the applicable fees and exchange rates.

3. Utilize Wells Fargo's online platform for tracking transfers.

4. Contact customer support for any questions or concerns.

5. Keep records of all your international wire transfer transactions.

Frequently Asked Questions:

1. What information do I need to send an international wire transfer with Wells Fargo? - Generally, you'll need the recipient's name, address, bank details, and the transfer amount.

2. How long does an international wire transfer with Wells Fargo take? - Processing times can vary, but are typically within a few business days.

3. What are the fees for Wells Fargo international wire transfers? - Fees vary based on the destination and transfer amount; check Wells Fargo's website for details.

4. Can I track my international wire transfer with Wells Fargo? - Yes, you can track your transfer's status through their online platform.

5. What security measures does Wells Fargo employ for international wire transfers? - Wells Fargo implements various security measures to protect against fraud and ensure secure transactions.

6. How can I contact Wells Fargo customer support for international wire transfer inquiries? - You can contact them through their website or by phone.

7. Are there limits on how much I can send via international wire transfer with Wells Fargo? - Yes, transfer limits may apply; contact Wells Fargo for details.

8. What should I do if my international wire transfer encounters a problem? - Contact Wells Fargo's customer support immediately for assistance.

Tips and Tricks: Initiate transfers during business hours for potentially faster processing. Maintain clear communication with the recipient to ensure smooth transactions.

In conclusion, managing international wire transfers effectively is essential in today's globalized world. Wells Fargo provides a platform for facilitating these transactions, offering a blend of convenience and security. By understanding the specifics of Wells Fargo's international wire transfer services, including their fees, processing times, and security measures, you can navigate the process with confidence. Leveraging the online platform, understanding the necessary documentation, and accessing customer support when needed will empower you to manage your international financial activities smoothly. Remember to stay informed about changes in regulations and best practices to ensure secure and efficient transfers. Taking the time to understand the nuances of Wells Fargo international wire transfers can significantly contribute to your overall financial well-being in an increasingly interconnected global economy. This empowers you to confidently manage your cross-border financial activities.

Elevate your desktop chris brown 4k wallpapers

Lost your boat gas cap key dont panic heres what to do

Decoding the lennox 2 ton condensing unit