Navigating Medicare: Understanding Humana Gold Choice

Are you approaching Medicare eligibility and feeling overwhelmed by the choices? You're not alone. Navigating the Medicare landscape can be challenging, with a plethora of plans and options. This article aims to shed light on Humana Gold Choice Medicare, a popular choice for many seniors. We'll delve into its features, benefits, and considerations to help you determine if it's the right fit for your healthcare journey.

Humana Gold Choice is a Medicare Advantage plan offered by Humana, a well-established health insurance provider. Medicare Advantage plans, also known as Part C, are offered by private insurance companies approved by Medicare. They provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage, like prescription drug benefits (Part D), vision, dental, and hearing. Choosing a Medicare Advantage plan like Humana Gold Choice bundles your coverage under one umbrella, simplifying your healthcare experience.

Understanding the nuances of Medicare Advantage plans is crucial for making informed decisions. Humana Gold Choice plans are available in various counties across the United States. The specifics of each plan—including premiums, deductibles, co-pays, and covered services—can vary depending on your location. Therefore, it's important to carefully review the plan details specific to your area. You can find this information on the Humana website or by contacting a Humana representative.

The history of Humana Gold Choice, like many Medicare Advantage plans, is intertwined with the evolution of Medicare itself. The Medicare Modernization Act of 2003 paved the way for the expansion of Medicare Advantage, allowing private insurers to offer more comprehensive plans to seniors. This fostered competition and innovation in the Medicare market, resulting in a wider range of plan choices for beneficiaries. Humana has been a key player in this landscape, offering a variety of Medicare Advantage options, including the Gold Choice plans.

Humana Gold Choice aims to address several key issues seniors face with healthcare. These plans strive to offer predictable costs, comprehensive coverage, and convenient access to care. By bundling services, they simplify the often-complex world of Medicare. For example, many Gold Choice plans include prescription drug coverage, eliminating the need for a separate Part D plan. This streamlines billing and simplifies medication management for beneficiaries.

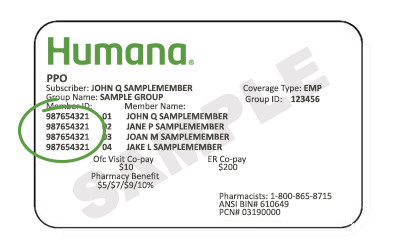

Humana Gold Choice plans have different cost-sharing structures, including HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) options. HMO plans typically require you to choose a primary care physician (PCP) and get referrals for specialist visits. PPO plans offer more flexibility, allowing you to see specialists without a referral, often at a higher cost-sharing amount.

Benefits of Humana Gold Choice: Some plans offer prescription drug coverage, vision benefits, and dental coverage.

Choosing the Right Plan: Carefully consider your health needs, budget, and preferred doctors when selecting a Humana Gold Choice plan.

Advantages and Disadvantages of Humana Gold Choice Medicare:

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Comprehensive Coverage | Network Restrictions (HMO) |

| Prescription Drug Coverage (in many plans) | Varying Premiums and Cost-Sharing |

| Extra Benefits (Vision, Dental, etc.) | Plan Availability by Location |

FAQ:

1. What is Humana Gold Choice? (Answer: A Medicare Advantage plan)

2. How do I enroll? (Answer: Contact Humana or visit their website)

3. Does it cover prescription drugs? (Answer: Many plans do)

4. Can I see any doctor? (Answer: Depends on the plan type - HMO or PPO)

5. What are the costs? (Answer: Varies by plan and location)

6. What is the difference between HMO and PPO? (Answer: Explanation of HMO and PPO)

7. How do I find a doctor in the network? (Answer: Humana provides online directories)

8. Can I switch plans? (Answer: Yes, during specific enrollment periods)

Navigating Medicare choices can seem daunting, but by understanding your options and taking the time to research, you can find a plan that meets your unique healthcare needs. Humana Gold Choice Medicare provides a range of plans with various benefits and cost structures. Remember to carefully consider your individual circumstances, compare plans in your area, and don't hesitate to contact Humana directly for personalized assistance. Choosing the right Medicare plan empowers you to take control of your health and well-being as you enter this new chapter of life. Take the time to explore Humana Gold Choice Medicare and see if it's the golden opportunity for your healthcare future.

Unlocking the power of sherwin williams greige the ultimate guide

The curious case of the phone hang up

Navigating the moral labyrinth raised by villains chapter 33

.gif)