Decoding Western Union Japan to Philippines Peso Transfers

So, you're staring at a pile of yen, itching to send it across the sea to loved ones in the Philippines. But how? And more importantly, how much will it *really* cost you? The world of international money transfers can feel like a confusing maze, especially when you're dealing with fluctuating exchange rates and transaction fees. Let's unravel the mystery of Western Union's Japan to Philippine peso (JPY to PHP) transfer rates.

Navigating the cost of sending money internationally isn't as simple as looking at the current exchange rate. Hidden fees, transfer speeds, and different payment methods all play a role in the final amount your recipient receives. Understanding these nuances is crucial for making informed decisions and maximizing the value of your hard-earned yen.

Western Union has a long history of facilitating international money transfers. It's a familiar name, often seen in bustling urban centers and quiet rural towns alike. But its ubiquity doesn't automatically make it the best option. Factors influencing the cost of a Western Union JPY to PHP transfer include the amount you're sending, how you're paying (cash, bank transfer, or debit/credit card), and how your recipient will receive the funds (cash pickup or bank deposit). All these variables dance together to determine the final cost.

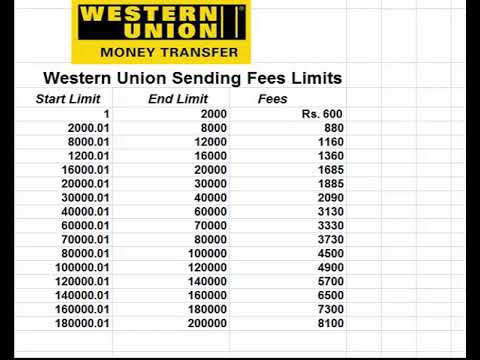

The cost of sending money through Western Union from Japan to the Philippines is comprised of two primary components: the exchange rate and the transfer fee. The exchange rate is the rate at which your yen are converted into pesos. This rate often differs from the mid-market rate you see on currency converter websites. Western Union adds a margin to this rate, which is how they generate profit. The transfer fee is an additional charge added on top of the exchange rate. This fee can vary significantly depending on the transfer amount and payment method.

Understanding Western Union's pricing structure is essential for budgeting your transfers effectively. It empowers you to compare their rates with other money transfer services and choose the most cost-effective option for your needs. Knowledge is power, and in the world of international money transfers, it can also save you money.

The fees associated with Western Union transfers from Japan to the Philippines can be affected by various factors including the speed of the transfer. Faster transfers typically incur higher fees. Payment method also plays a role. Paying with a credit card might be convenient, but it can lead to higher charges than paying with cash or a bank transfer.

One simple example: Sending ¥100,000 via Western Union might result in your recipient receiving, say, ₱45,000 after the exchange rate and fees are applied. It's essential to use Western Union's online cost estimator or visit a local agent to get a precise quote for your specific transfer.

While convenient, there are limitations. Fluctuations in exchange rates can affect the final amount received, and transaction fees can be higher compared to some online money transfer services.

Advantages and Disadvantages of Western Union

| Advantages | Disadvantages |

|---|---|

| Widely accessible with numerous agent locations globally | Potentially higher fees compared to online competitors |

| Cash pickup options for recipients without bank accounts | Exchange rates can be less favorable than the mid-market rate |

| Relatively fast transfer speeds | Fees can vary significantly based on payment and delivery methods |

Frequently Asked Questions:

1. How long does a Western Union transfer take? Transfers can typically arrive within minutes or a few business days.

2. Can I track my transfer? Yes, Western Union provides a tracking service.

3. What identification do I need? Valid government-issued photo ID.

4. What are the limits on how much I can send? Limits vary depending on your transfer history and local regulations.

5. What if the recipient doesn't pick up the money? The funds can usually be refunded.

6. How do I find a Western Union agent location? Use the locator on their website.

7. Can I cancel a transfer? Cancellation policies vary; contact Western Union directly.

8. Are there other options besides Western Union? Yes, numerous online money transfer services exist.

Tips and Tricks: Compare rates and fees before sending. Consider using a debit card or bank transfer instead of a credit card to minimize charges. Check for promotional discounts or offers.

In conclusion, sending money from Japan to the Philippines via Western Union requires careful consideration of various factors. Understanding the interplay between exchange rates, transfer fees, payment methods, and delivery options is key to optimizing your transfers. While Western Union offers convenience and a wide network, comparing their services with other providers can help ensure you're getting the best deal. Evaluate your specific needs, weigh the pros and cons, and empower yourself to make informed decisions about your international money transfers. By taking the time to research and compare, you can ensure that your hard-earned yen goes as far as possible for your loved ones in the Philippines. Don't just click the first button you see – explore your options, and send your money wisely.

Sage green exterior paint with brick a refreshing home update

The chicken little i dont believe you anymore meme phenomenon

Chelan county food permits a comprehensive guide