Decoding the Western Union Money Transfer Maze

Need to fling funds across the globe? Western Union's yellow and black logo might be the first thing that pops into your head. But before you rush to the nearest agent or fire up their app, let's dive deep into the often-murky waters of Western Union send money cost. This isn't just about the advertised fees; it's about understanding the whole shebang, including hidden charges and how to get the most bang for your buck.

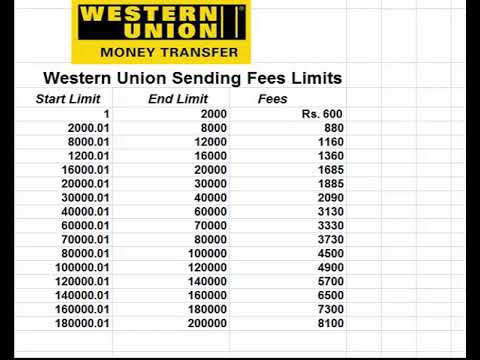

So, how much does it *actually* cost to send money with Western Union? Well, that's a question with a complex answer. The Western Union money transfer price depends on a variety of factors, including the amount you're sending, the destination country, the payment method you choose (bank transfer, cash pickup, or mobile wallet), and the current exchange rate. Navigating this fee landscape can feel like deciphering ancient hieroglyphics, but with a little knowledge, you can avoid unnecessary expenses.

Western Union's history dates back to the mid-19th century, originally as a telegraph company. They later expanded into financial services, capitalizing on their existing network to facilitate money transfers. Today, they're a global giant in the remittance industry, connecting millions across borders. The importance of understanding Western Union send money cost lies in the sheer volume of transactions they process. Even a small difference in fees or exchange rates can add up to significant amounts for individuals and businesses who regularly use their services.

One of the main issues surrounding Western Union's pricing is the lack of transparency. While they do publish fee schedules, the final cost isn't always clear until the transaction is complete. This can lead to unexpected surprises and make it difficult to compare their rates with other money transfer providers. Moreover, the exchange rates offered by Western Union are often less favorable than the mid-market rate, meaning you're effectively paying a premium for the convenience of their service.

Let's break down a simple example. Suppose you're sending $100 to a friend in Mexico. The advertised fee might be $5, but the exchange rate offered by Western Union could be lower than the market rate, meaning your friend receives less than the equivalent of $95 after conversion. This "hidden" cost is crucial to factor into your calculations when comparing Western Union's pricing with other options.

While there are challenges related to Western Union fees, there are also benefits. Western Union has a vast global network, making it convenient to send money to even remote locations. They also offer various payment and delivery options, catering to different needs. Additionally, their brand recognition and established infrastructure can provide a sense of security for some users.

Advantages and Disadvantages of Western Union

| Advantages | Disadvantages |

|---|---|

| Wide global reach | Potentially high fees and unfavorable exchange rates |

| Various payment and delivery options | Lack of price transparency |

| Brand recognition and established infrastructure | Limited customer support options in some regions |

Frequently Asked Questions:

1. How can I find the Western Union send money cost? - Visit their website or app.

2. What factors influence the cost? - Destination country, amount sent, payment method.

3. Are there hidden fees? - The exchange rate might be less favorable than the market rate.

4. How can I compare Western Union's pricing with other providers? - Use online comparison tools.

5. Is Western Union a safe way to send money? - They have security measures in place, but be aware of potential scams.

6. Can I track my transfer? - Yes, through their website or app.

7. What if my recipient doesn't receive the money? - Contact Western Union customer support.

8. What are some alternatives to Western Union? - There are various online money transfer services like Wise, Remitly, and WorldRemit.

Tips and tricks: Compare rates, consider the exchange rate, choose the right payment method, and be wary of scams.

In conclusion, understanding the true Western Union send money cost requires more than just glancing at the advertised fees. It's about factoring in the exchange rate, considering alternative money transfer services, and being aware of potential hidden charges. By doing your research and comparing options, you can make informed decisions and ensure you're getting the best value for your money. Don't let the complexities of international money transfers intimidate you. With a little knowledge and careful planning, you can navigate the remittance landscape with confidence and send your money where it needs to go, without breaking the bank. Remember to always double-check the final cost before confirming your transfer, and explore different services to find the most cost-effective solution for your specific needs. Ultimately, empowering yourself with information is the key to mastering the world of international money transfers and making sure your hard-earned cash reaches its destination efficiently and affordably.

Decoding kate martins team affiliation

Conquer house siding moss a comprehensive guide

Conestoga college downtown kitchener campus exploration