Decoding the SECU Bank Code Mystery

So, you're trying to navigate the labyrinthine world of financial institutions, and you've stumbled upon this mythical beast: the State Employees Credit Union bank code. Don't worry, you're not alone. It's a jungle out there, full of cryptic numbers and confusing jargon. Let's shed some light on this whole bank code business, specifically when it comes to SECUs.

First off, let's be clear. "State Employees Credit Union bank code" can refer to a few different things. Are we talking about the routing number? The SWIFT code? Maybe even something more obscure? It's like trying to order coffee in a foreign language – you kind of know what you want, but you're not sure how to ask for it. This ambiguity can be a real pain, especially when you're trying to do something as simple as setting up direct deposit or making an international wire transfer.

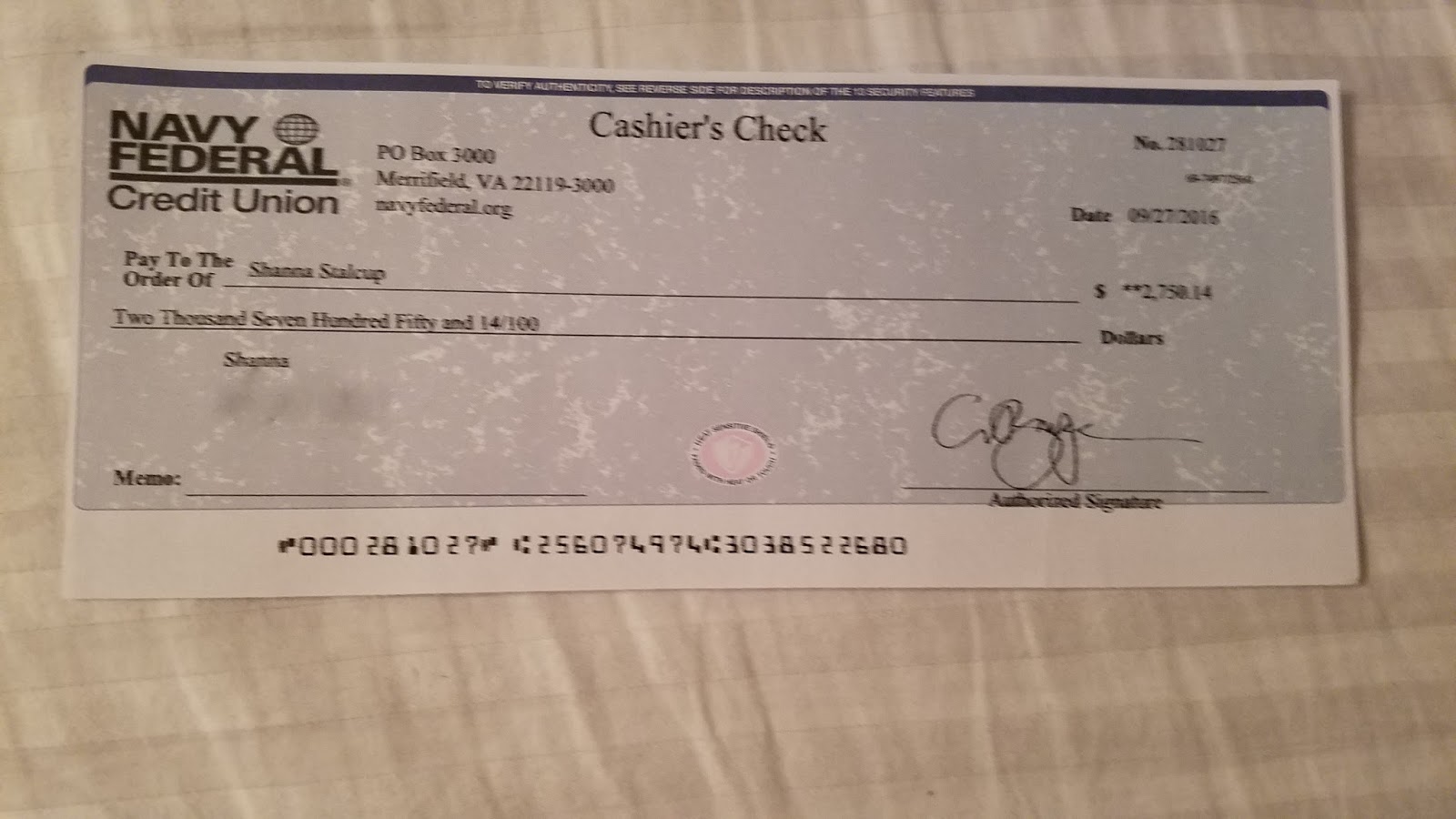

Let's break down the most common "bank code": the routing number. This nine-digit number identifies the specific financial institution and is essential for processing transactions like direct deposits, automatic bill payments, and wire transfers. Think of it as the address of your credit union. Without it, your money might end up… well, who knows where. It's like sending a letter without a zip code – good luck with that.

Now, the routing number for a State Employees Credit Union (SECU) can vary depending on the specific SECU and sometimes even your branch. This is where things get tricky. You can usually find your specific routing number on your checks, your online banking platform, or by contacting the credit union directly. It's like a secret handshake – you need to know the right one for the right situation.

Beyond the routing number, you might encounter the term "bank code" in reference to a SWIFT code, which is used for international transactions. This alphanumeric code is like a global passport for your money. Not all SECUs have SWIFT codes, as they primarily serve a domestic clientele. If you need to make an international transfer, you might need to use a corresponding bank that does have a SWIFT code.

The origins of routing numbers trace back to the early 20th century as a way to streamline interbank transactions. They've become an integral part of the modern financial system, enabling the smooth flow of funds across the country and around the world. However, with the rise of online banking and mobile payments, new identification systems are emerging, but routing numbers remain a cornerstone of the financial infrastructure.

One common issue with bank codes is simply finding the right one. With so many different codes for different purposes, it can be confusing to know which one you need. Always double-check the specific code required for your transaction to avoid delays or errors.

Advantages and Disadvantages of Using Credit Unions

| Advantages | Disadvantages |

|---|---|

| Lower fees | Fewer branches and ATMs |

| Better interest rates | Limited services compared to large banks |

| Member-owned focus | May require membership eligibility |

Best Practices for Managing Your SECU Accounts:

1. Regularly monitor your account activity. This helps you catch any unauthorized transactions quickly.

2. Keep your contact information updated. This ensures the credit union can reach you with important information.

3. Use strong passwords and enable two-factor authentication. This adds an extra layer of security to your account.

4. Familiarize yourself with the credit union's policies and procedures. This will help you avoid any surprises.

5. Contact the credit union directly if you have any questions or concerns. They are there to help you.

FAQ:

1. What is a routing number? A routing number identifies a specific financial institution.

2. What is a SWIFT code? A SWIFT code is used for international transactions.

3. Where can I find my SECU routing number? On your checks, online banking, or by contacting SECU.

4. Do all SECUs have the same routing number? No, it can vary.

5. What if I use the wrong routing number? Your transaction may be delayed or rejected.

6. How can I protect my SECU account? Use strong passwords and monitor your account activity.

7. What are the benefits of being a SECU member? Lower fees, better rates, member-owned focus.

8. How can I contact SECU? Visit their website or call their customer service number.

In conclusion, navigating the world of "state employees credit union bank codes" can seem daunting, but it's manageable once you understand the key players. Whether you're dealing with routing numbers for domestic transactions or SWIFT codes for international transfers, accurate information is crucial. By understanding these codes, utilizing best practices, and staying informed about your credit union's policies, you can ensure smooth and secure financial transactions. Take advantage of the resources available to you, whether it's online banking, customer service, or educational materials. Your financial well-being is worth the effort.

Finding your ideal phone number solution

Patricia costello a glimpse into the life of lou costellos daughter

Conquer your philadelphia traffic tickets the ultimate guide