Canceling Your Bank Account Like a Pro: The Letter Format Guide

Ever felt the urge to sever ties with your bank? Maybe you're moving to a new country, consolidating accounts, or just plain fed up with the fees. Whatever the reason, closing a bank account isn’t as simple as walking away. You need a formal letter—a digital handshake, if you will—to finalize the separation. This guide dives deep into the proper bank account closure letter format, ensuring a clean break without any lingering financial headaches.

Terminating your relationship with a financial institution requires a specific approach. A well-crafted bank account closure request ensures your funds are transferred correctly, recurring payments are canceled, and you avoid unwanted fees. This isn't about sending a hastily scribbled note; it's about following a format that protects your financial interests.

So, what's the big deal about a simple letter? Well, imagine sending an email saying, "Close my account." Which account? What about the money in it? A formal account termination letter clarifies these details, preventing confusion and potential delays. Think of it as the official "off" switch for your financial connection with the bank.

From addressing the correct branch and including vital account details to requesting confirmation of closure, each element of the account termination letter plays a crucial role. We'll explore each component, ensuring you're equipped with the knowledge to compose a letter that leaves no room for misinterpretation. This isn't just about closing an account; it's about doing it right.

Let's dive into the history and significance of this seemingly mundane, yet incredibly important, document. In the pre-digital age, written correspondence was the primary method of communication, making the bank account closure letter an essential tool. Even in today’s digital world, its importance remains, providing a clear and documented record of your request. While some banks may offer online closure options, a formal letter often remains the preferred method, especially for complex situations or accounts with large balances.

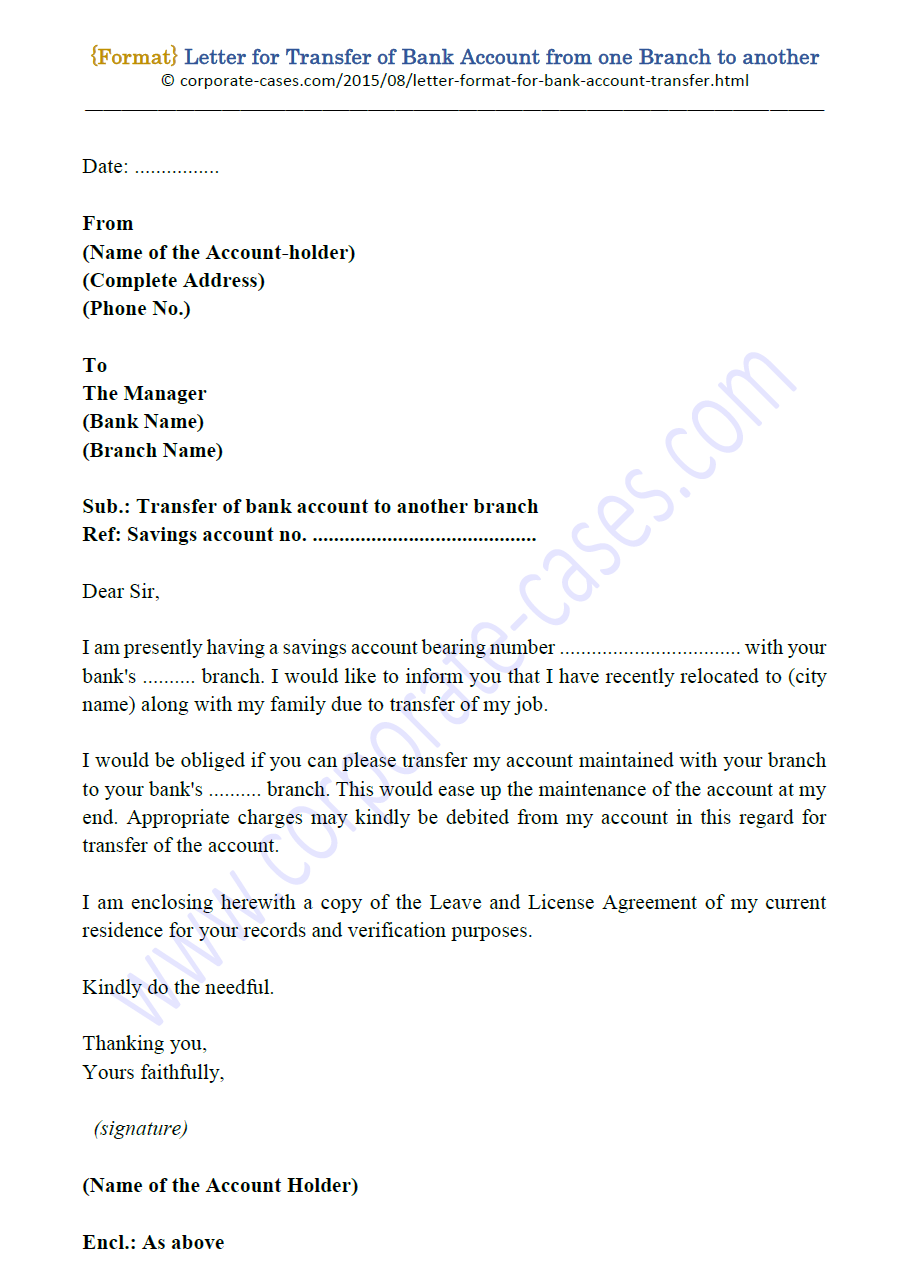

A standard bank account closure letter should include your name, address, account number, the date, the bank's address, and a clear request to close the specified account. You should also specify where you want the remaining funds transferred. For example, "Please transfer the remaining balance to [account number] at [bank name]."

Benefits of using a formal letter format for bank account closure include: a clear and documented record of your request, minimized chances of errors or miscommunication, and a higher degree of professionalism. For example, imagine disputing a charge after an informal closure. A formal letter provides evidence of your request and timeline.

Action Plan: 1. Gather your account details. 2. Draft your letter using a template or following the recommended format. 3. Review for accuracy. 4. Send the letter via certified mail for proof of delivery.

Advantages and Disadvantages of Using a Formal Letter

| Advantages | Disadvantages |

|---|---|

| Provides a clear record | Can be slower than online methods |

| Minimizes miscommunication | Requires more effort than online methods |

| Professional and formal | May require physical mailing |

Best Practices: 1. Always keep a copy of your letter. 2. Confirm account closure with the bank. 3. Update any automatic payments linked to the closed account. 4. Verify zero balance after closure. 5. Dispose of old checks and debit cards securely.

FAQs: 1. What if I don’t know my account number? – Contact the bank for assistance. 2. Can I close a joint account by myself? – This depends on the bank’s policy and the type of joint account. 3. How long does it take to close an account? – Typically within a few business days. 4. What happens to any pending transactions? – The bank will usually process them before closing the account. 5. Can I reopen a closed account? – This depends on the bank’s policy.

Tips and Tricks: Consider sending your letter via certified mail for confirmation of delivery. This provides you with proof that the bank received your request. Also, follow up with the bank by phone or email a week after sending your letter to confirm the account has been closed.

In conclusion, mastering the bank account closure letter format empowers you to navigate this crucial financial process with confidence and precision. By understanding the importance of each element within the letter – from your accurate contact information to the specific instructions regarding fund transfer – you avoid potential complications and ensure a smooth transition. Whether you're streamlining your finances, switching banks, or simply closing an unused account, the formal letter format serves as a vital tool for a clean break. Remember, a well-crafted letter not only safeguards your financial interests but also demonstrates professionalism and attention to detail. Take the time to follow the recommended format and best practices outlined in this guide, and you'll be well-equipped to close your bank account effectively. Don’t leave this important financial task to chance. Use this guide to ensure a smooth and hassle-free account closure process. Start crafting your letter today and take control of your financial future.

Finding your dream bmw x5 in rock hill sc

Discovering central baptist church paragould

Romantic good morning messages for your love